Tax Implications of the EB-5 Visa: What Investors Need to Know

Acquiring a US green card through the EB-5 visa not only unlocks new opportunities but also triggers substantial changes in your tax obligations.last updated Thursday, December 26, 2024

#FBAR Filing #FBAR and FATCA

| | John Burson | Subscribe |

QUICK LINKS

AD

Get access to EB 5 Visa Investment Projects

Key Points

- EB-5 investors are taxed on worldwide income once they become U.S. residents.

- Must file Form 1040 for global income and FBAR for foreign accounts.

- Exit tax applies when renouncing U.S. permanent residency.

- The Substantial Presence Test impacts U.S. tax obligations.

- Seek professional guidance for compliance.

EB-5 visa holders are subject to US tax on their worldwide income. This means that the US and other parts of the world's income become subject to US taxes. EB-5 visa holders must also disclose their global accounts, assets, and investments to the US government. EB-5 visa holders are also subject to an exit tax when relinquishing permanent residence or citizenship.

In this article, we will cover:

- EB-5 Visa Holders and Tax Obligations

- Tax Implications of Green Card Acquisition

- Required Documents for EB-5 Investors

- Professional Guidance and Compliance

- FBAR Filing and Automatic Extension

- Common Concerns about Penalties

EB5 investors with significant sources of income from outside the US will not only have to report all sources of income but may find they have to pay tax on some of that income if they have not met certain tax minimums.

Securing a US green card through the EB-5 visa programs provides new prospects and changes your tax situation significantly. As an EB-5 investor, understanding the tax implications is critical for making educated decisions and planning. Here's a breakdown of significant issues to examine, which includes information from government sources:

Understanding Basics of Tax Implications for Eb-5 Visa

EB-5 Investor/U.S. Tax Issues

Upon entering the U.S. as an EB-5 investor, you transition into a U.S. income tax resident, signifying immediate taxation on worldwide income. This includes earnings both within and outside the United States.

Acquiring a US green card through the EB-5 visa unlocks new opportunities and triggers substantial changes in your US tax EB-5 Visa.

For EB-5 investors, understanding these tax implications is essential for making informed decisions and effective financial planning. From the moment of entry into the U.S., the EB-5 investor is annually obligated to comply with U.S. Income Tax regulations involving the filing of various documents.

- Form 1040 reports worldwide income;

- Foreign Financial accounts over $10,000 file Form TDF 90- 22.1, Report of Foreign Bank and Financial Accounts, “FBAR Filing,” due June 30th following tax year (separate tax filing);

- Foreign Financial Assets valued in excess of $50,000 file Form 8938, “Specified Foreign Financial Assets” attached to Form 1040 (Foreign Account Tax Compliance Act “FATCA Filing”).

It's crucial to note that submitting Form 8938 alongside Form 1040 doesn't exempt U.S. taxable residents from the obligation to file FBAR Form TDF 90-22.1 when it's due. Failure to report foreign bank and financial accounts willfully, as required by Form 1040/Schedule B (Part III, Foreign Accounts and Trusts) and TDF 90-22.1, can lead to severe consequences.

Criminal penalties may include up to 10 years in jail, a $500,000 fine, and civil penalties of 50 percent of the account balance annually. For instance, if FBAR isn't filed for four years, the civil penalty amounts to 200 percent of the account balance.

Until an investor receives the EB-5 visa, they are considered a nonresident alien, US tax return, and are subject to a flat 30 percent tax on U.S. source income not effectively connected with the conduct of a U.S. trade or business.

In such cases, a tax withholding agent must withhold 30 percent of the gross amount paid to a foreign taxpayer unless valid documentation (IRS Form W-8) confirming the U.S. payee (Foreign National) as a "beneficiary" is obtained.

Here's a breakdown of key points to consider:

Resident Alien Status

- When you get your green card, you become a resident alien for tax purposes, which means your whole income is subject to US taxation. This applies to income earned within and outside the United States, including salary, investments, real estate, and company interests.

- Substantial Presence Test: Even without a green card, if you spend enough time in the United States (30 days this year and 183 days in the previous three years), you may be deemed a resident alien for tax reasons. Be aware of your travel plans and potential tax implications.

Tax Rates and Reporting

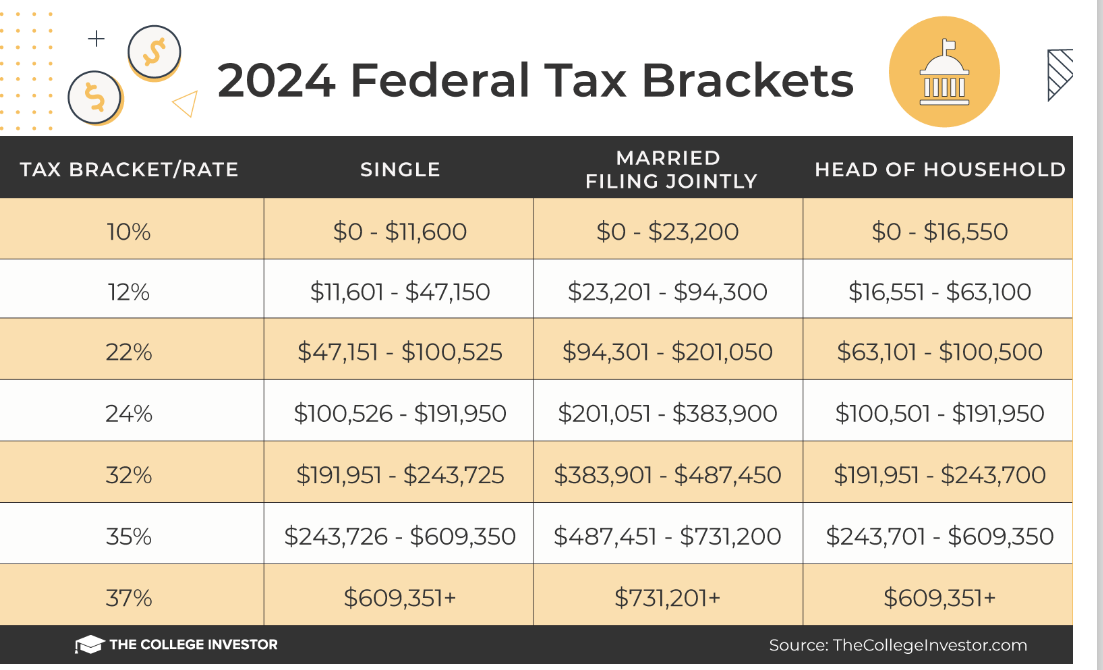

Source: IRS tax bracket table

- Depending on your income level, you will be liable to the same progressive income tax rates as US citizens, which could reach 23.8% for long-term capital gains.

- You must file annual federal tax returns that include all your income sources, regardless of origin. Depending on where you live, you may also be required to file state tax returns.

Specific Considerations

- Exit Tax

When you renounce your green card or US citizenship, you may be subject to an exit tax on unrealized capital gains on your global assets. Specific exclusions and planning measures can help to mitigate this impact. - FBAR and FATCA

You may be obliged to file FBAR (Foreign Bank Account Report) and FATCA (Foreign Account Tax Compliance Act) forms if you have financial accounts outside the United States that exceed specific criteria.

Seeking Professional Guidance

To navigate the complexities of your new tax situation, consult a qualified tax counselor or attorney specializing in EB-5. They can help you:

- Assess your individual tax liability and potential risks.

- Develop tax planning strategies to optimize your financial situation.

- Ensure compliance with all relevant reporting requirements.

Remember:

- Tax consequences of the EB-5 visa can be significant but not insurmountable.

- Proactive planning and expert guidance can help you minimize your tax burden and maximize your financial benefits.

You can ensure a smooth transition into your new tax landscape as an EB-5 investor by approaching this with informed awareness and seeking professional support.

Compliance and Reporting

EB-5 Visa & U.S. Tax: FATCA & FBAR

When someone from another country is in the U.S. with an EB-5 investment visa, they're considered a temporary visa holder. Despite this, they might still have to pay U.S. taxes on their global income and report foreign accounts and assets to the IRS, similar to a U.S. citizen or a Legal Permanent Resident (Green Card Holder). Navigating IRS rules for U.S. tax obligations with an EB-5 visa can be intricate to overcome foreign investor visa issues. Whether the EB-5 visa holder has U.S. tax responsibilities and worldwide reporting duties depends on meeting the Substantial Presence Test (SPT).

The Substantial Presence Test involves using specific ratios to count days over the past three years. It determines how long the individual has been in the U.S. If an EB-5 visa holder meets the substantial presence criteria, they are liable for U.S. tax on global income. Additionally, they must disclose their global accounts, assets, and investments to the U.S. government unless specific exceptions, exclusions, or treaty positions apply.

EB-5 Visa and U.S. Taxes

A common challenge for EB-5 Visa holders arises after residing in the U.S. for more than six months – determining their U.S. tax status. The question is whether they still qualify as a nonresident or if they've inadvertently become a U.S. resident for tax purposes due to the substantial presence test. If the latter is true, additional filing and reporting obligations come into play under FATCA (Foreign Account Tax Compliance Act), notably the annual FBAR statement reporting foreign accounts. EB-5 Visa holders who are non-compliant with tax regulations can enter programs to achieve tax compliance.

What is the Substantial Presence Test?

If you're not a U.S. citizen or green card holder, you typically only need to pay taxes on income earned while working in the United States (referred to as "US Effectively Connected Income"). However, if you meet the Substantial Presence Test, the IRS will tax you on your income worldwide.

IRS Substantial Presence Test generally means that you were present in the United States for at least 30 days in the current year and a minimum total of 183 days over three years, using the following equation:

- 1 day = 1 day in the current year

- 1 day = 1/3 day in the prior year

- 1 day = 1/6 day two years prior

Example A

If you were here 100 days in 2016, 30 days in 2015, and 120 days in 2014, the calculation is as follows:

- 2023 = 100 days

- 2022 = 30 days/3= 10 days

- 2021 = 120 days/6 = 20 days

Total = 130 days, so you would not qualify under the substantial presence test and NOT be subject to U.S. Income tax on your worldwide income (and you will only pay tax on money earned while working in the US).

Example B

If you were here 180 days in 2016, 180 days in 2015, and 180 days in 2014, the calculation is as follows:

- 2023 = 180 days

- 2022 = 180 days/3= 60 days

- 2021 = 180 days/6 = 30 days

Total = 270 days, so you would qualify under the substantial presence test and be subject to U.S. Income tax on your worldwide income unless another exception applies.

FBAR Due Date and Extension

The FBAR (Foreign Bank and Financial Accounts Report) is a document that informs the U.S. Government about foreign bank and financial accounts. The usual deadline for this form is April 15, but it currently has an automatic extension. If you haven't submitted the FBAR (FinCEN Form 114) by April 15, you have until October to file it. Importantly, as it is automatically granted, you don't need to submit an extension form like Form 4868 or 7004 for the FBAR extension.

Form 8938 Due Date and Extension

Form 8938 reports foreign assets to the IRS under FATCA (Foreign Account Tax Compliance Act). It's somewhat similar to the FBAR but not the same. You file Form 8938 along with your tax return, and its deadline aligns with your tax return deadline. For individuals filing a Form 1040, Form 8938 is due in April, along with the tax return. If you decide to extend the time for filing your tax return, the deadline for Form 8938 is also extended.

Form 3520 Due Date and Extension

Form 3520 is utilized for reporting foreign gifts and details about foreign trusts. The usual deadline for Form 3520 is April 15. However, taxpayers can extend the filing deadline by requesting an extension for their tax return that year. Like Form 8938, there's no need for a specific Form 3520 extension form; it's simply an extension of the underlying tax return.

Form 3520-A Due Date and Extension

Form 3520-A is employed to disclose U.S. ownership of a Foreign Trust. Unlike Form 3520, the due date for Form 3520–A is typically in March, not April. Moreover, the procedures for filing an extension for Form 3520-A differ, subject to substitute filing rules. To prolong the deadline for submitting Form 3520-A, the taxpayer must submit a distinct Form 7004 extension form.

Form 5471 Due Date and Extension

Form 5471 is employed to declare ownership in specific foreign corporations. The filing deadline aligns with the due date of a person's tax return. If the taxpayer opts for the primary tax return extension, Form 5471's deadline is also extended. Over recent years, Form 5471 has grown notably more intricate. Therefore, taxpayers should know the varied filing demands and plan accordingly.

Addressing Common Concerns

- Late Filing Penalties May be Reduced or Avoided

If taxpayers have missed the deadline for filing their FBAR and other international information-related reporting forms, the IRS offers various offshore amnesty programs to help them comply safely. These programs can potentially lessen or eliminate penalties related to international reporting. - Current Year vs. Prior Year Non-Compliance

Once a taxpayer has missed tax and reporting obligations in previous years, they should exercise caution before submitting information to the IRS in the current year. Simply starting to file for the current year or mass filing past year forms without using one of the approved IRS offshore submission procedures may result in a quiet disclosure, posing risks.

Before filing untimely foreign reporting forms, taxpayers should consult a Board-Certified Tax Law Specialist specializing exclusively in offshore disclosure matters. - Avoid False Offshore Disclosure Submissions (Willful vs Non-Willful)

Recently, the IRS has thoroughly examined specific streamlined procedure submissions. If an individual's actions are non-willful, they stand a good chance of successfully using the Streamlined Procedures. Conversely, those who act willfully should opt for the IRS Voluntary Disclosure Program.

However, if a willful taxpayer intentionally provides false information under the Streamlined Procedures and gets caught, they may face substantial fines and penalties.

Source: Eb-5 Investors and US Tax Issues

Frequently Asked Questions

As an EB-5 visa holder, am I required to pay taxes in the U.S.?

Yes, once you enter the U.S. on an EB-5 visa, you become a U.S. income tax resident and are subject to taxes on worldwide income.

What is the Substantial Presence Test, and how does it impact my tax status?

The Substantial Presence Test is a counting-day test that determines your U.S. residency. Meeting the criteria may subject you to U.S. tax on global income.

Are there specific forms for reporting foreign accounts and assets?

Yes, forms like FBAR (FinCEN Form 114), Form 8938, Form 3520, and others may be required to report foreign financial information.

Is there an exit tax when relinquishing permanent residence or citizenship?

Yes, EB-5 investors may be subject to an exit tax when giving up their permanent resident status or citizenship.

What are the penalties for late filing or non-compliance with tax regulations?

Late filing may result in penalties. Willful failure to report foreign accounts can lead to criminal penalties and substantial fines.

How does the FBAR filing deadline work, and can it be extended?

The FBAR is due on April 15, with an automatic extension until October. No separate extension form is required.

What are the options for EB-5 investors who are out of tax compliance?

Depending on circumstances, programs are available for non-compliant investors to enter and become tax-compliant.

Can I avoid U.S. tax on income earned outside the U.S.?

If you meet certain conditions, you may be subject to a flat 30 percent tax on U.S. source income that is not effectively connected with a U.S. trade or business.

What is the significance of Form 5471, and when is it due?

Form 5471 is used to report ownership in certain foreign corporations. Its deadline aligns with the taxpayer's tax return due date.

How can I ensure compliance with tax regulations as an EB-5 investor?

Seek professional guidance, understand the filing requirements, and stay informed about changes in tax laws to ensure compliance with U.S. tax regulations.

Sources:

- IRS website: https://www.irs.gov/

- USCIS website: https://www.uscis.gov/

- American Immigration Lawyers Association (AILA): https://www.aila.org/

Subscribe to Paperfree Magazine

Similar Pages

Search within Paperfree.com